In June 2019, Aspen EPIC – an initiative of the Aspen Institute Financial Security Program – surveyed over 100 diverse experts on housing affordability and stability. Following extensive literature review and in-depth interviews with dozens of experts, the survey enabled us to receive feedback on the core problems we identified as contributors to rising unaffordability and instability and refine our understanding of the drivers of these problems.

Along with scarce household financial resources and the rising cost of housing across the US, a key theme that emerged in the survey results is the role of racial exclusion in shaping past and present housing conditions in ways that impact people of all races. Structural barriers such as redlining, discrimination, and disinvestment have historically kept black households from securing quality rents and mortgages. These effects strongly reverberate today as households of color face less access to adequate and safe housing than white households. Throughout the survey, respondents expressed their belief that racial equity should be a priority for EPIC as we examine drivers and solutions. Highlights of our key learnings from the survey responses follow below.

FINANCIAL SECURITY CHALLENGES

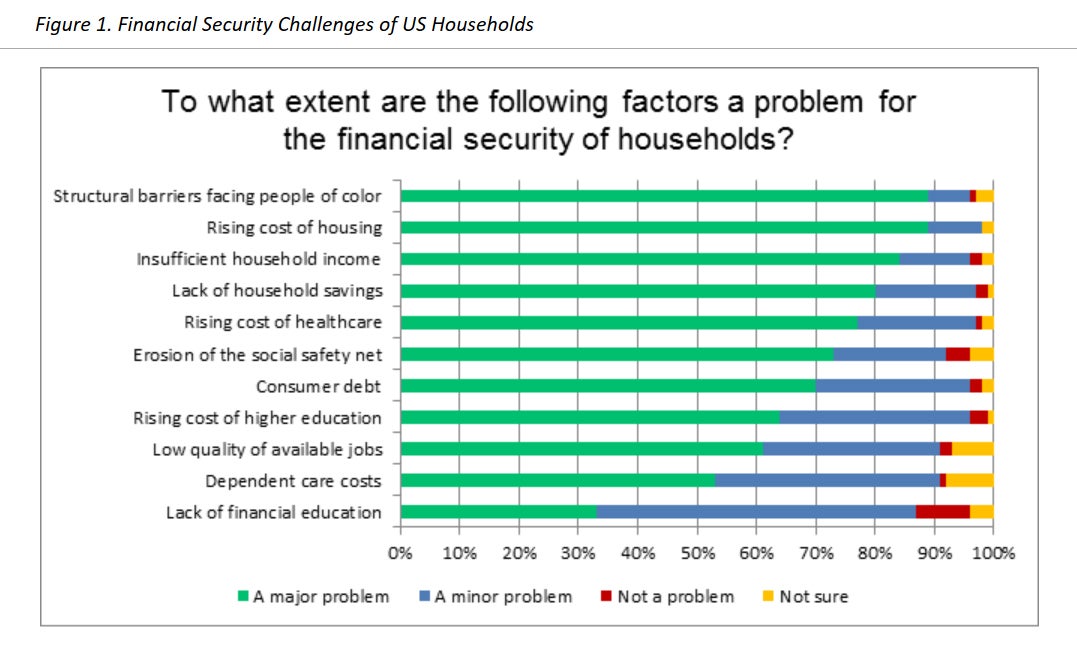

The survey began with a question on the relative importance of several challenges that impact household financial security, each of which have been identified in previous surveys conducted by EPIC. Over 95% of respondents prioritized the rising cost of housing and structural barriers facing people of color, which include segregation, discrimination, and racial inequality, as the top challenges facing households today (Figure 1). Household-level factors of insufficient income and a lack of savings closely followed, with over 80% of experts viewing both as a major problem for households.

FOUR CORE PROBLEMS AT THE HEART OF UNAFFORDABILITY AND INSTABILITY

When asked to describe their perspective on why so many US households lack stable and affordable housing today, experts’ survey responses point to four core problems:

- In all markets, some proportion of households have incomes so low that they cannot afford any market-rate housing in their area and most eligible households lack housing assistance to make up the difference.

- In some markets, developing and operating market-rate housing is so costly that it is difficult to supply housing that is affordable to moderate and middle-income households in quantities sufficient to meet rising demand.

- In all markets, policy choices and structural factors including segregation, discrimination, and generations of compounding inequality inflate the cost of housing available to households of color at all income levels and low-income households of all races and ethnicities.

- In some markets, renters are systematically disadvantaged by local laws and regulations, increasing their rates of housing cost burden and instability.

DRIVERS OF UNAFFORDABILITY AND INSTABILITY

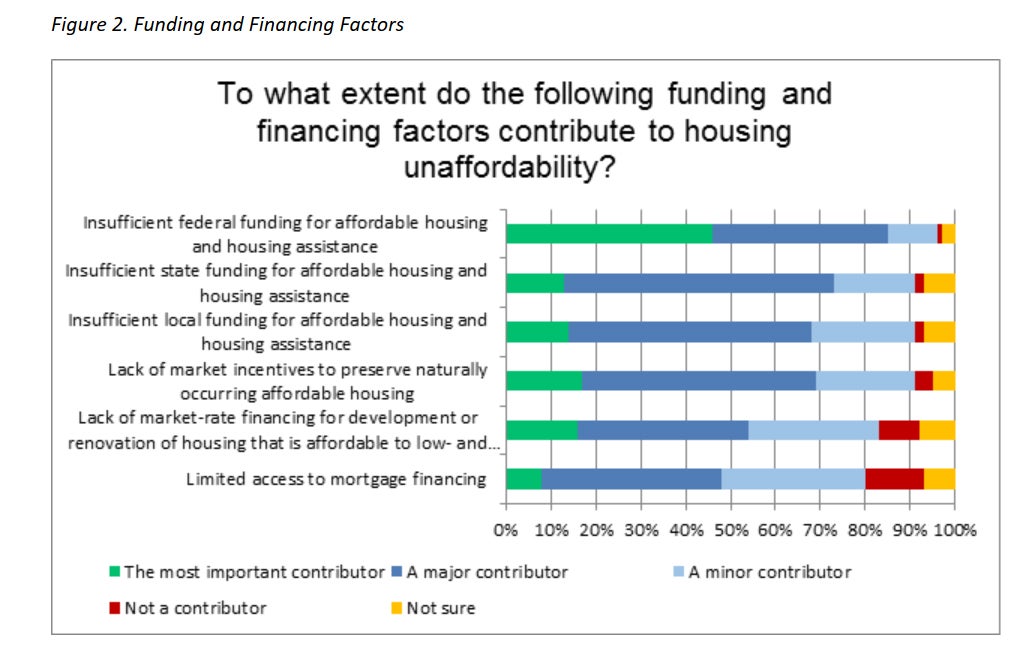

Experts also indicated significant convergence around their analysis of drivers of affordability and instability that correspond to the four key problems above. These include drivers related to funding and financing factors, supply and demand factors, and household financial conditions. For funding and financing factors, over 90% of the experts we surveyed believe that there is insufficient federal, state, and local funding for affordable housing and housing assistance (Figure 2).

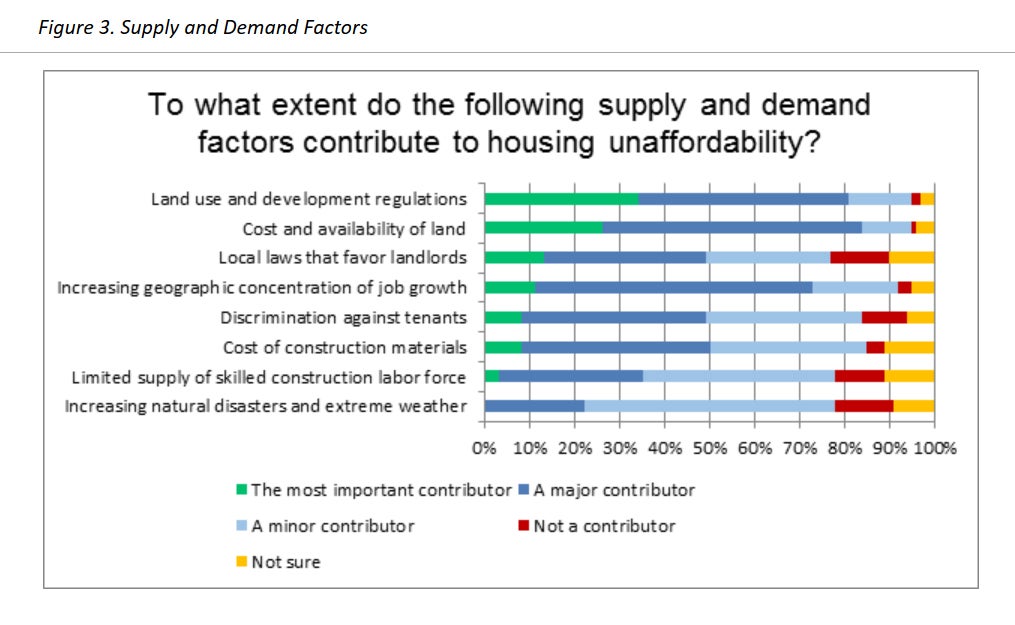

For supply and demand factors, 95% of experts believe that land use and development regulations and the cost and availability of land are important contributing factors that increase the costs of developing and operating market-rate housing (Figure 3). This is followed by the increasing geographic concentration of job growth, chosen by 92% of experts.

Experts noted that supply and demand factors vary greatly depending on the market type. The most popular market types were those characterized as high-demand, high-cost markets with supply challenges (ex. San Francisco, New York, Boston). Experts also characterized low-demand, low-cost markets with preservation challenges (ex. Cleveland, Detroit, Milwaukee). Lastly, experts noted “middle markets” that are characterized as high-demand and low-cost. Some of these “middle markets” typically have decent affordability (ex. Houston, Memphis) and some have worsening affordability (ex. Atlanta, Denver). However, given the rise in housing costs across the nation, low-income households face affordability challenges in all market types, including urban and rural.

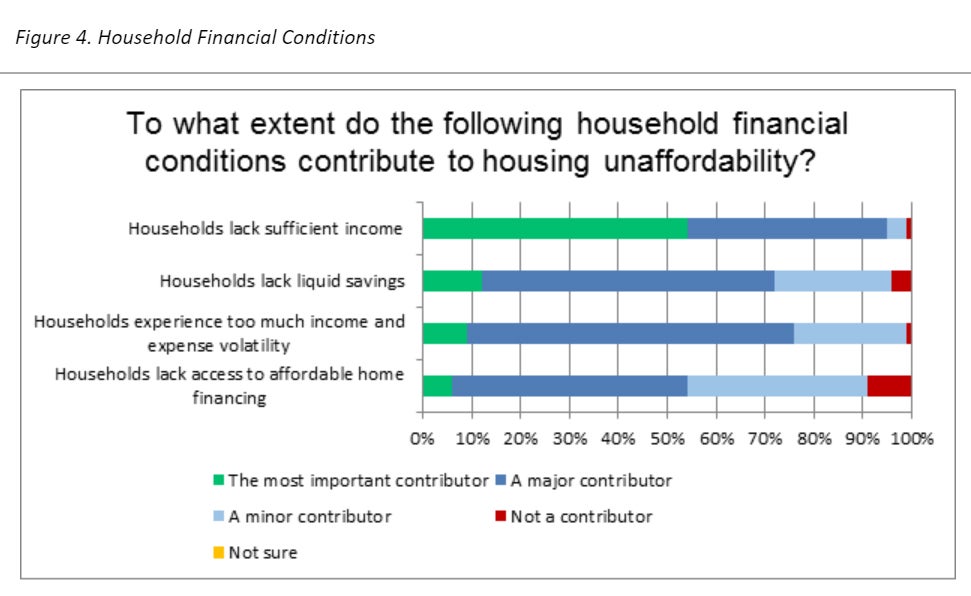

While income was the main household financial condition selected as impacting affordability and stability, experts also believe that volatility and savings play a large role. After paying for housing costs, many lower and moderate-income households don’t have enough remaining income or savings to weather financial shocks. Over 95% of experts chose all three of these factors as important household conditions that contribute to unaffordability (Figure 4). Each of these factors are especially consequential for the stability of low-income households and can result in increased evictions, foreclosures, and homelessness.

Experts agreed that housing instability can be caused by both economic and non-economic reasons that are exacerbated by household financial conditions. Economic reasons can include missing rent and mortgage payments or increasing rent and property taxes. Non-economic reasons can include the quality and safety of a housing unit and neighborhood or mental, physical, and emotional health challenges. Renters, in particular, face higher risk of instability due to increases in rents, local laws that favor landlords, and systems that make it hard to regain stable housing once it has been lost, such as tenant blacklisting.

Additional obstacles to housing affordability and stability for some households noted by expert respondents include systemic inequality and discrimination. Inequitable land codes and wealth policies primarily affect households of color, reducing access to affordable housing. Furthermore, access to good jobs, quality schools, and other community resources is often just as important for housing affordability and stability. Lastly, many households, particularly low-income households and households of color, face challenges in affording and accessing homeownership. Over half of the experts we surveyed believe that the greatest barrier to homeownership is the lack of savings for a down payment, followed by other financial challenges such as low credit scores, volatile income, and consumer debt.

While the economy has rebounded since the Great Recession, respondents to this expert survey have also observed uneven economic growth across the nation, decreasing growth of housing supply, and significant changes to the experience of renting and buying that have acute impacts on millions of US households. Aspen EPIC will be using these survey results to clarify and deepen our understanding of the drivers and impacts of housing unaffordability and instability and guide our decisions about future research. In December 2019, Aspen EPIC will be releasing a Primer on Housing Affordability and Stability. Following, we will take the steps to explore and highlight promising and thoughtful solutions being implemented in many communities across the United States.

SURVEY RESPONDENTS

EPIC invited more than 500 experts to take the survey and received 103 complete responses and 19 partially completed responses. Invitees included members of the EPIC Housing Advisory Board, academic and think tank researchers; mortgage lenders; multifamily financers; housing tax credit syndicators; housing authority leaders; local, state, and federal government officials; representatives from the homebuilding industry; real estate agents; developers of market-rate and affordable housing; nonprofit housing organizations and others who provide financial security services to low-income households. Respondents were concentrated in the research (37%) and nonprofit (17%) sectors, with additional respondents from across the private (14%) and public (11%) sectors.