Canceling at least $30,000 in student loan debt for all borrowers is one of the most powerful tools policymakers have to ensure that, when the pandemic ends, millions of people and families will be able to fully participate in the economic recovery.

If policymakers do nothing, we risk a repeat of years of economic expansion after the Great Recession which for many never led to full financial recovery: as of 2019, the typical household in the US still had less wealth in real terms than they did in 2007. Canceling at least $30,000 for all (or nearly all) borrowers would put 43 million people on more sustainable paths to financial security. It would enable people to permanently do what they did during the pandemic when their payments were paused—pay down other debts and jump-start their savings. Thirty thousand dollars is the minimum needed to ensure that student loan cancellation eliminates debt for those who have experienced the greatest hardship in paying it back, helps close the racial wealth gap, and launches wealth building.

On the campaign trail in 2020, then-Presidential candidate Biden announced that, if elected, he would forgive $10,000 of federal student loan debt per borrower. Still, the Biden administration has not moved to implement that policy. However, in March 2020, monthly payments were suspended and the interest rate set to zero, making student loans less of a priority issue. Now, with the federal payments pause extended until May 2022 and the pandemic continuing to threaten the strength of economic recovery, the time has never been better to forgive student loan debt. The federal government should move swiftly to reduce all borrowers’ debts by at least $30,000 before payments resume in May.

Student loan debt cancellation helps families build financial security

The “right amount” of student loan debt cancellation depends on what goals federal policymakers hope to achieve. From the financial security perspective, the design and execution of the policy should prioritize these three goals:

- Meaningfully assist borrowers with the greatest need

- Significantly reduce racial wealth gaps

- Set the economic recovery on the path toward the right goal: wealth building for all

Canceling $30,000 per borrower at a minimum—roughly the cost of one academic year at an in-state, public, 4-year institution—is the right amount to meaningfully address these goals.

How student loan debt cancellation of $30,000 targets those most in need

Canceling $30,000 of student loans per borrower would immediately end obligations for millions of borrowers, including eliminating debt for almost half of the lowest-wealth borrowers, freeing up a new monthly stream of income to divert to other needs. Cancellation of this amount would be concentrated among those struggling most with student loan debt. It would eliminate loans for the majority of those in default before the pandemic, as 77.6% of borrowers owe $40,000 or less in defaulted student loans. According to data from the JP Morgan Chase Institute, over 75% of borrowers in low- and middle-income households (first, second, and third income quintiles) would have their outstanding student loans eliminated through $30,000 in student debt cancellation. At $10,000, that number drops to less than half.

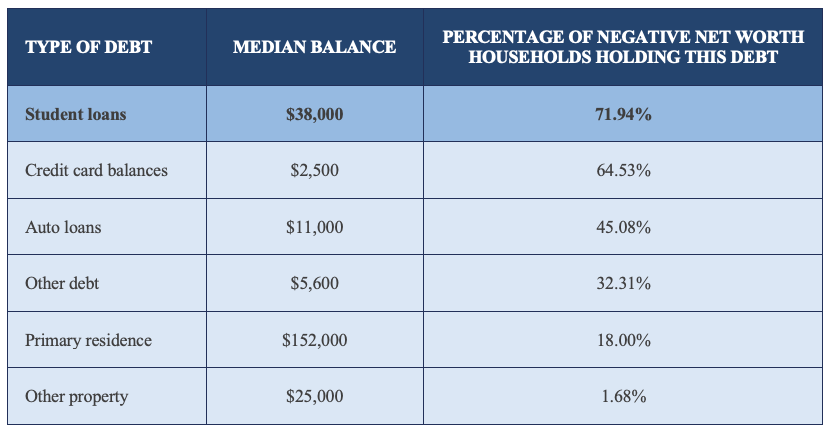

Student loan debt is the primary driver of negative net worth

Aspen FSP’s analysis of 2019 Survey of Consumer Finances data shows that student loan debt is the primary driver of financial insecurity for an important but under-discussed set of households: those with negative net worth. According to our analysis of the Survey of Consumer Finances, 1 in 10 households had more debt than assets in 2019. This group is disproportionately made up of low-income households, households of color, and households led by single mothers. Importantly, student loan debt was the most common type of debt for households in net debt, with households in this group holding a median of $38,000 (Our forthcoming report on household wealth will discuss these findings in greater depth). For those households, $10,000 would only remove a fraction of their debt; $30,000 is an amount that would have a chance of ensuring student debt is not a significant barrier to sustainable wealth creation moving forward. This finding is consistent with other research by the Roosevelt Institute that found that when measured by household assets, student debt cancellation is progressive and that more substantial cancellation is more progressive, especially above $10,000.

Figure 1. Debt holding rates and median values among negative net worth households (2019)

Source: Aspen FSP analysis of Federal Reserve, 2019 Survey of Consumer Finances.

Lower levels of student loan cancellation would not significantly close racial wealth gaps

Thirty thousand dollars of student debt cancellation is enough to meaningfully address racial wealth gaps. It would eliminate loans for the majority of Hispanic and Latino borrowers. The impact on Black borrowers would also be substantial, as the average balance for Bachelor’s degree recipients is above $50,000. Millions of others could have lower payments or pay off their loans years faster. In contrast, while $10,000 in loan forgiveness would provide some relief, the majority of borrowers would still be making similar monthly payments on larger balances; it would do little to grow the net worth of low-wealth households or reduce racial inequities.

A recent analysis by the Roosevelt Institute of the Federal Reserve’s Survey of Consumer Finances finds that Black households would benefit systematically more from higher levels of student debt cancellation, in part because when Black students graduate from college they owe on average $7,400 more than their white peers. This mirrors findings by the JP Morgan Chase Institute that student debt cancellation of all levels would especially benefit Black households. With these facts in mind, it is unsurprising that many leading experts in the racial wealth gap include student debt cancellation as a key component of strategies to close the racial wealth gap.

Student loan forgiveness would aim economic expansion toward the right goal: wealth building for all

The Great Recession recovery kickstarted the longest period of economic growth in modern history. During that period, however, wealth ultimately only grew for less than 10% of the population, while the typical household in America still had less wealth in real terms entering 2020 than they did in 2007. Allowing that to happen again will not just perpetuate the wealth gap—it will exacerbate it. What stands before us is an opportunity to ensure economic fairness is incorporated into economic recovery. If we do nothing, student loan debt could be what keeps 43 million people from building much-needed wealth to be more resilient for the next downturn.

Broad-based cancellation would not just relieve financial pressure on households in need—it would jump-start wealth building for low- to moderate-income households. Holding student loan debt diminishes people’s ability to invest and save in opportunities that we know will build wealth for their families and communities:

- Fifty-five percent of college graduates with student loan debt reported it was a barrier to savings for emergencies, a critical on-ramp for wealth building, especially low-income households. According to research by Morningstar, the existence of student loan debt was associated with 36.4% lower retirement savings balances in 2020. A recent study found that from 2009 to 2019 homeownership among student loan borrowers has dropped by 24 percent, particularly in Black and Asian census tracts. The Philadelphia Federal Reserve found that higher levels of student debt have a significant impact on small business formation.

What the “Pause” revealed about how people spend money

The temporary pause of student loan payments gave us a preview of what people would do with their surplus cash: they paid down debts, increased savings, and put money toward down payments in homes. Millions of borrowers who had been in default before the pandemic brought their accounts back into good standing; the federal student loan default rate has fallen from 11.1% at the end of 2019 to 5.3% in September 2021, the lowest level in two decades. The truth is that people across America know how to save money and invest in economic opportunity—many simply need help tackling debt first.

The pandemic payments pause has demonstrated that relieving the burden of student loan payments has major benefits for borrowers and few, if any, drawbacks for others. Nearly all of the 43 million federal student loan borrowers stopped making payments in March or April 2020, with no negative impact on the economy or the federal government’s ability to meet its obligations. Yet, as the date to restart loan payments approaches, the majority of borrowers are concerned about their ability to resume payments.

This is the time for bold action on student loan cancellation. Borrowers who are worried about resuming payments would benefit from assured stability, people who used the payment pause to shore up their finances would be able to build on their progress, and millions of families would be able to invest in themselves, their communities, and their futures.