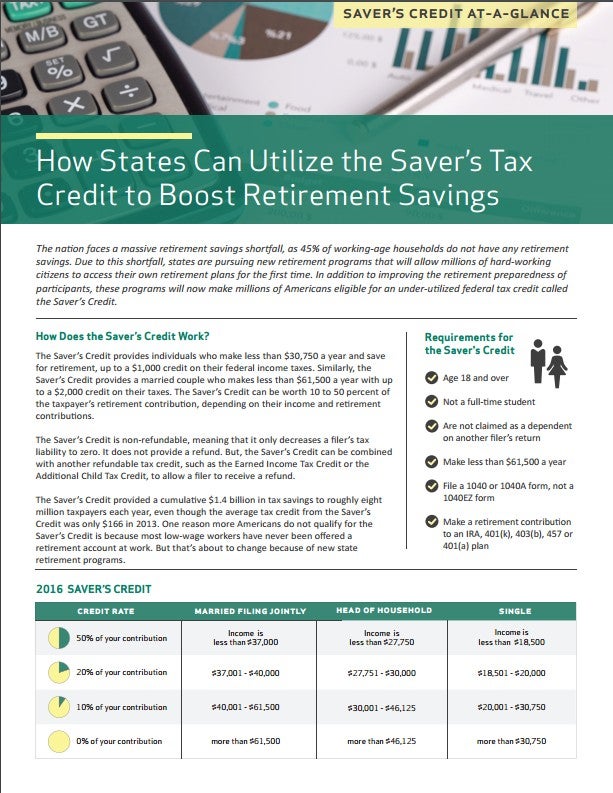

The nation faces a massive retirement savings shortfall, as 45% of working-age households do not have any retirement savings. Due to this shortfall, states are pursuing new retirement programs that will give millions of their hard-working citizens access to their own retirement plans for the first time. In addition to improving the retirement preparedness of participants, these programs will make millions of Americans newly eligible for an under-utilized federal tax credit called the Saver’s Credit.

How States Can Utilize the Saver’s Tax Credit to Boost Retirement Savings

View this Publication

Download PDF

Next Post