The finance and healthcare sectors are growing rapidly, with jobs in each sector expected to grow by 16 and 18 percent, respectively, between 2018 and 2028, compared to an expected five percent growth rate across all occupations. The projected job growth demonstrates how much innovation is happening in each sector, and opens possibilities for exploring new avenues for collaboration between the two. Indeed, the connection between financial wellness and health is significant, with evidence showing that increased financial security is linked to improved health outcomes and improved quality of life.

Over the past several months, the Financial Security Program and the Health, Medicine and Society Program, embarked on a unique collaboration to explore the link between good health and financial wellbeing. Working together, the programs are moving forward with the opportunity to examine the common essential building blocks of healthcare, medicine, wellness, and financial well-being.

Feedback on this dynamic collaboration has been positive and meaningful. Our valuable takeaways so far include:

- The private sector is leading the way on this effort.Given the role of the private sector in generating wealth through job creation and bolstering the social safety net through provision of benefits like health care and retirement, their inclusion in these conversations is critical. At Aspen Ideas: Health (the three-day opening event of the Aspen Ideas Festival), Jamie Kalamarides, President of Prudential Group Insurance, underscored the importance of a multidisciplinary approach to financial security: “I want to assert that financial wellness is so inextricably tied to overall wellness and mental health and that it is our duty as both employers, but also as financial services providers, healthcare providers, to deliver outcomes that are improving the financial health of individuals and communities.”

- A committed focus on racial and gender equity would strengthen the results of this work and collaboration.According to the Robert Wood Johnson Foundation, the average American white family has over $170,000 in household wealth, compared to just $20,600 for Hispanic families and $17,100 for Black families. These disparities impact the ability of families to access affordable healthcare, safe living conditions, nutritious food, quality education, and other resources that impact long-term financial and health well-being. Much of this is rooted in decades of discriminatory public policy. Work to intertwine financial and health success must have a specific focus on racial equity.

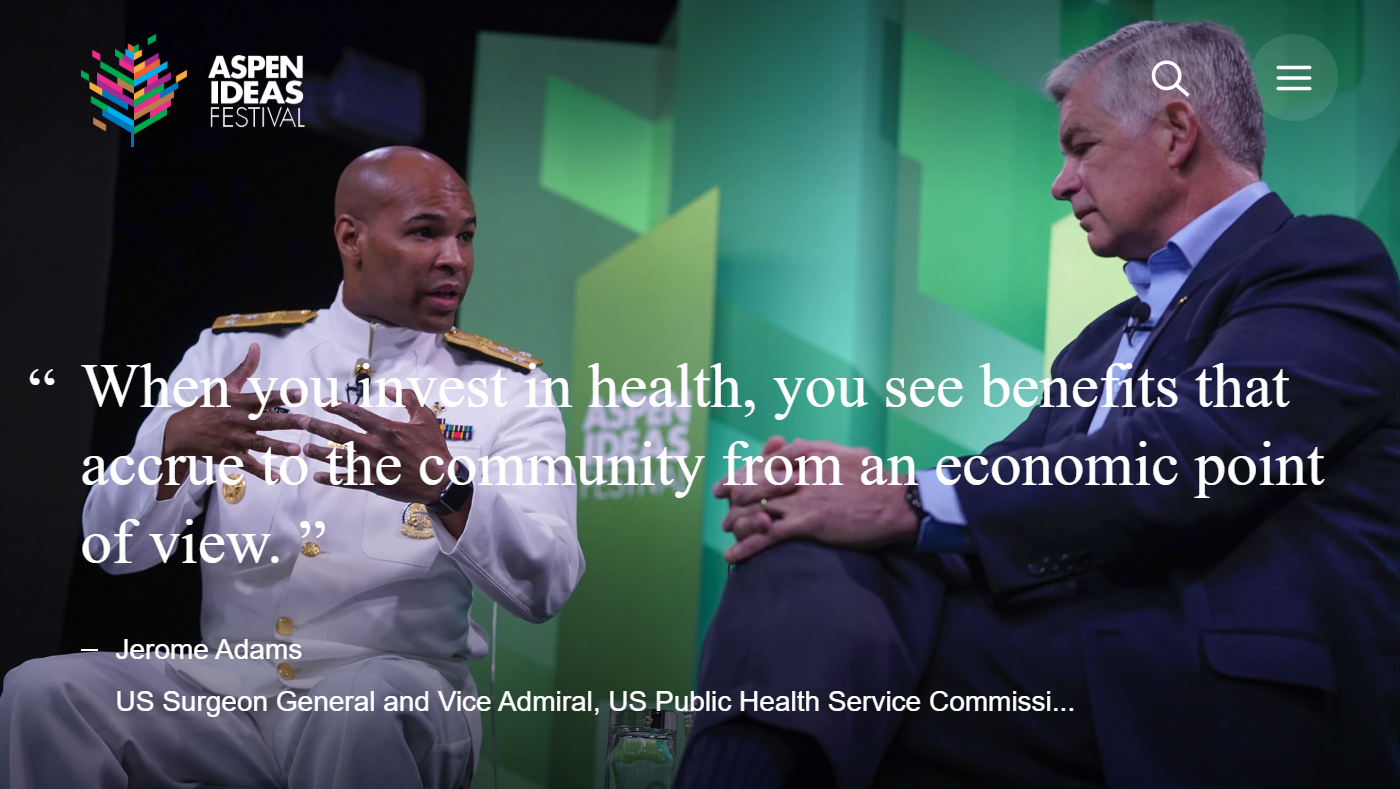

- We must focus on the macro and the micro conversations. There is an ongoing need to better understand the macro implications of these two fields working together. Bringing together the US Surgeon General and the Federal Reserve Bank of Philadelphia was just the start. During Aspen Ideas: Health, President Harker of the Federal Reserve Bank of Philadelphia shared how they are increasingly looking to partner with public health professionals to turn their research on workforce development, job creation, and infrastructure into measures of resulting health outcomes in local communities. At the same time, there is important work happening in communities across the country. For example, during another panel, Dr. Lucy Marcil shared how her nonprofit StreetCred raises awareness about EITC eligibility and provides tax preparation services in doctors’ offices and hospitals while parents wait for children to receive care.

- These two fields are eager to be brought together more intentionally — and work remains.There is a strong recognition that the communities of health and wealth share common goals. They are eager to better communicate and interact with each other. While synergy is present, it is clear that these two fields are speaking in different languages. A new vernacular and shared understanding needs to be built for greater collaboration and impact. An example of how sectors are already working together in a more meaningful way is being led by the National Credit Union Foundation. In their report, “Health and Financial Wellbeing: Two Good Things that Go Better Together,” they make the case for credit union and healthcare collaboration. Some credit unions are already doing this, like Allegacy Federal Credit Union in North Carolina partnering with Wake Forest Baptist Health to form a new credit union service organization called WellQ, which provides bundled services such as financial and health coaching and education to both members and non-members.

- There is a need to set an inclusive table grounded in research and data. As with any effort, the table must be representative in order to be effective. While we kicked off with an excellent and wide-ranging group of leaders and executives, we need more change makers from health and financial sectors to join this conversation, and they need a safe space grounded in research and data to engage in this work.

Long-lasting improvement on the issues of financial and health inequality require multidisciplinary solutions that understand these issues are intricately linked. We invite you to join us in improving health outcomes that will allow people to live longer and healthier lives, and participate more fully in the economy.