Just five months ago we announced the launch of this new initiative of ours – EPIC – the Expanding Prosperity Impact Collaborative.

EPIC focuses on one distinct issue at a time that is critical to the financial security of Americans but not widely understood. The process will serve as a catalyst that raises both the profile and priority-level of household financial challenges in order to spur effective action. In fact, we just posted a new video about EPIC and the process we have developed. Check it out here.

As you may remember, our inaugural issue is Income Volatility. And for the last several months we have been hard at work with our Advisory Group, convening participants, and survey respondents trying to come to convergence about how we understand the scope and scale of the problem and its impact on specific populations. This has led to one brief that synthesizes the current research and a second, forthcoming brief (late September 2016) that lays out the policies, products, and practices that might reduce volatility or mitigate its worst effects. So make sure to come back to our site to check it out.

Understanding Income Volatility

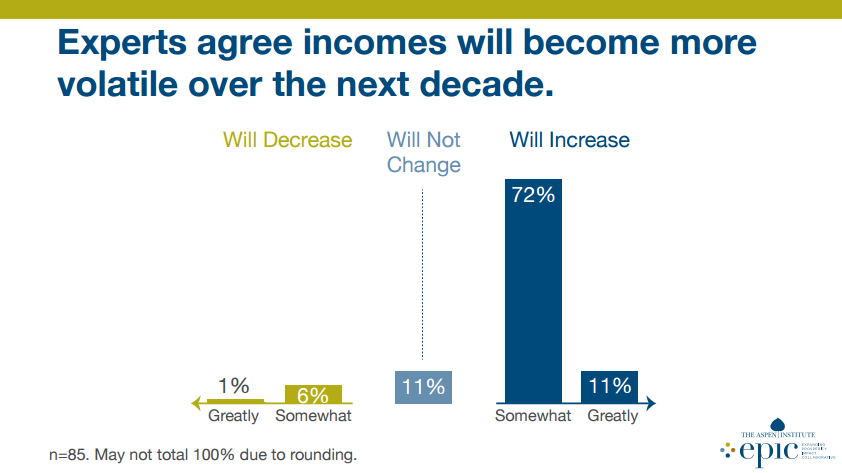

Over the course of 4 months, we surveyed 150+ experts on income volatility and its impact on the financial lives of Americans. Click on the image below to learn more about our survey process and explore our findings.

EPIC Talk

Through conversations, interviews, and blog posts, you can engage in our discussions with experts, including researchers, financial service innovators, policymakers, advocates, and more:

- Watch new videos: conversations with EPIC convening participants Marla Blow, Rachel Schneider, Maureen Conway, Rachel Deutsch, Marissa Guananja, and others about how to solve for income volatility.

- Follow our new interview series: Bradley Hardy on the intersection on volatility and race, Ariane Hegewisch on the role of gender in income volatility, Mariel Beasley on solutions to reduce volatility for workers, and Aparna Mathur on how job training can help reduce volatility, with more to come next week.

- Read our blog posts: In Is There a Racial Volatility Gap?, former FSP intern Judith Garber looks into whether people of color experience greater rates of income volatility; in the Ripple Effects of Volatility, Joanna Smith-Ramani and David Mitchell examine volatility’s impact on communities, states, regions, and the country as a whole; and in new reflection, Tim Ogden looks back at some of the thought-provoking conversations from the second EPIC convening.

What Is All the Research Telling Us?

Our first issue brief, “Income Volatility: A Primer,” was a comprehensive literature review of what is known about the prevalence, causes, and impact of income volatility. Stay tuned for our next brief, a solutions framework that lays out potential solutions for mitigating and managing volatility at both the household and societal levels.

What We’re Reading

Our work is informed by the great research and insights of our colleagues. Here’s a short list of some of the work we have been digging into:

- Report on the Economic Well-Being of U.S. Households in 2015 (Federal Reserve)

- Thriving Residents, Thriving Cities: Family Financial Security Matters for Cities (Urban Institute)

- (10)99 Problems and W2s Ain’t One (Core Innovation Capital)

- Portable Benefits Resource Guide (Aspen Institute Future of Work Initiative)

- Spikes and Dips and other Issue Briefs (U.S. Financial Diaries)

- The Role of Emergency Savings in Family Financial Security (Pew Charitable Trusts)

- Paychecks, Paydays, and the Online Platform Economy: Big Data on Income Volatility (JPMorgan Chase & Co. Institute)

- Financial Capability in the United States 2016 (FINRA Investment Education Foundation)

Engage With Us

EPIC is a collaborative process and we want you to contribute to the conversation. Follow new developments and tweet about EPIC using @Aspen_FSP and #AspenEPIC. And, if you have a personal story about volatility in your own life, we want to hear it. Email us at EPICinfo@aspeninstitute.org.