Executives have more room than they realize to stand together with sophisticated investors to maintain focus on long-term value creation.

Public-company managers are quick to bemoan the pressures they face to emphasize short-term financial performance at the expense of long-term value creation. Depending on the day, they point the finger at a range of culprits, including market pressure, economic uncertainty, and investors. But it’s time managers took a harder look at themselves and the tools they have to build alliances against the corrosive effects of corporate short-termism.

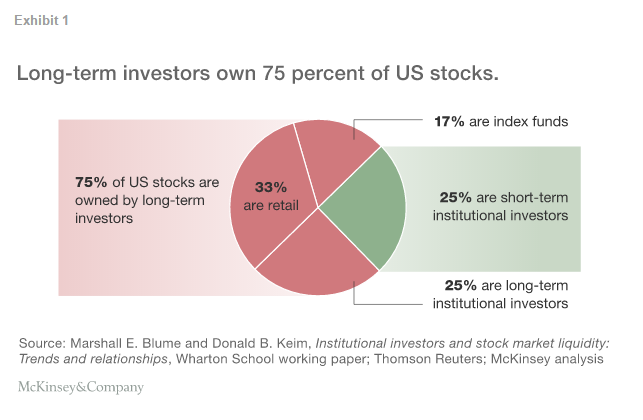

It is true that short-term investors and their proxies, sell-side analysts, are the most visible participants on quarterly earnings calls and in contacting companies for the insights upon which they trade. The pace and volume of those trades may often dominate a company’s daily trading activity. But it’s worth recalling that short-term investors are usually a minority of a company’s shareholders. Overall, they own only around 25 percent of shares held by US companies (Exhibit 1). In fact, seven in ten shares of US companies are owned by longer-term investors: individuals, index funds, and more sophisticated long-term investors.

As prior McKinsey analysis has shown, this last group, also known as intrinsic investors, has an outsize influence on a company’s share price over time. With their deep understanding of a company’s intrinsic value and their willingness to make large investments, they often see even bad news, in the short term, as an opportunity to increase their holdings of a company whose strategy and management they support. That gives companies more room than many managers realize to make decisions that create long-term value—even at the risk of short-term volatility. This also benefits all long-term shareholders by keeping share prices in line with a company’s intrinsic value and preventing prices from falling too far out of line, relative to the company’s peers.

Executives need to understand intrinsic investors better. To begin an ongoing dialogue, McKinsey and the Aspen Institute Business & Society Program1 convened a group of public-company CFOs and intrinsic investors in late 2014 to discuss their mutual interests. The following year, as discussions continued, we also surveyed and interviewed intrinsic investors, with an average holding period of six years. Our interpretation of these discussions and survey results does not necessarily reflect the views of every participant. But the consensus of the group was that all public-company CEOs, CFOs, and corporate boards should be doing what they can to attract and retain a critical mass of intrinsic investors in order to blunt the effects of short-termism and best support a strategy of long-term value creation.

Our research indicates that four initiatives seem to resonate with intrinsic investors and could prove useful for managers eager to achieve this goal. They include pursuing long-term value creation even at the expense of short-term earnings, proactively structuring investor communications, resisting artificial efforts to meet earnings targets, and rethinking management’s approach to quarterly earnings calls.

Pursue long-term value even at the expense of short-term earnings

An overreliance on short-term measures of earnings per share can be a distraction from the long-term trajectory of a company’s share price. When asked to react to hypothetical trade-offs between short-term earnings and long-term value creation, past McKinsey surveys have found, only half of companies would make an unambiguously long-term decision when confronted with options for a major strategic challenge.

In contrast, intrinsic investors overwhelmingly favor decisions that lead to long-term value creation even at the expense of short-term earnings shortfalls. Consider, for example, an investment scenario that tested investors’ support for a range of potential management responses to a major decline in short-term profits, resulting from a large change in foreign-exchange rates. The company, based in the United States, earned 70 percent of its revenues and profits abroad. Nineteen of 24 intrinsic investors in our group2 said they would be neutral if the company took no action and simply reported lower profits. On the other hand, nearly two-thirds said they would take a negative view of an order for across-the-board cost reductions. Intrinsic investors realize that companies can’t control or predict exchange rates and don’t want companies to take arbitrary cost-cutting actions to meet current earnings expectations that may hurt the business later.

We then asked, assuming exchange rates stayed the same, whether the company should accelerate cost cutting in the following year to keep its earnings rising, even if long-term revenues could be negatively affected. Twenty-one out of 23 intrinsic investors viewed this negatively. In subsequent interviews, some investors noted that this could lead to a downward spiral, where reductions in investments like marketing and sales would produce lower revenue growth, which would then lead to more reductions in marketing and sales expenditures to keep short-term earnings from declining.

Another scenario tested investor reactions to a new CEO’s decision to continue operating a legacy unit even though it was a money loser and had no expectation of turning profitable. Seventeen out of 24 of the investors from our panel had a negative view of sustaining the unit to avoid recognizing the shutdown costs, while 20 were neutral or positive about the company shutting it down—despite the one-time hit to earnings. Most favored an attempt to divest the unit in the CEO’s first year on the job, with the only dissenter worried that action in year one might be a bit too quick.

Take charge of investor communications

With respect to investor communications, intrinsic investors tell us they favor companies with executive teams that are confident about telling their companies’ stories the way the teams see them, proactively choosing how, what, and when to communicate. Many of our survey panelists felt that is the opposite of what many companies do today. To paraphrase one investor, “An exceptional CEO knows what I need to know and tries to persuade me of that. He or she doesn’t try to guess what I want to hear.”

Intrinsic investors expressed this as a desire for what they called education. One investor told us, “I just need to be educated. Help me understand your business and strategy. If I disagree, I don’t have to invest.” They want to know what a company’s competitive advantages are and how its strategy builds on those advantages. They want to know what external and competitive forces a company faces. And they want to know what concrete actions the company is taking to realize its aspirations—including efforts to ensure it has the talent to succeed. They don’t want sugarcoating, opacity, or “selling.” They also see right through overly elaborate presentations as a potential lack of substance.

Related to education, investors want to learn how a CEO makes decisions, whether the company’s approach is aligned with long-term value creation, and whether the whole management team is singing from the same song sheet. This is not surprising, given that 23 out of 24 of our long-term investors rate management credibility as one of the most important factors they consider in making investments. Management credibility includes not just clarity of decision making but also openness when not everything goes well. One investor put it this way: “There are always bumps in the road. You earn trust and respect by not trying to sugarcoat. That doesn’t mean the stock price won’t go down. But it will mean the recovery will be better because investors will have more confidence in managers who are level headed and matter of fact.” Another investor said, “I get them to talk about something other than what’s in their pitch book. I want to know how they think. For example, what’s their rationale for a particular decision that will increase value?”

Another theme we heard from intrinsic investors, one supported by behavioral psychology, is that managers would do well to ensure that the long term and its context are part of every investor engagement, especially when talking about short-term results. Start with the long term as the wide lens and then zoom in on the details, as needed. As one investor averred, “It’s all about the horizon. Long-term investors don’t need a lot of detailed guidance about quarterly numbers. They need clarity, consistency, and transparency from managers in communicating strategic priorities and their long-term expectations.”

Resist artificial moves to meet earnings targets

Many companies believe they are forced to game their quarterly earnings, even if they don’t like this. A number of studies have shown that it is common for companies to defer investments to meet short-term earnings targets. One of the earliest found that 80 percent of CFOs would reduce discretionary spending on value-creating activities, such as marketing and R&D, in order to meet their short-term earnings targets. And nearly two-fifths of CFOs would give discounts to customers to make purchases this quarter rather than next.3

Most long-term institutional investors deplore such moves. From one investor: “We think that running a business with a goal of meeting consensus expectations for revenue or earnings per share creates temptations for suboptimal choices. We prefer to invest in businesses with fewer, simpler long-term goals and no near-term guidance.”

That has implications for the pressure companies feel, whether real or perceived, to report steadily increasing earnings each quarter—for the quarterly call itself, for the comparison of earnings with analysts’ consensus estimates, and even for the practice of providing earnings guidance. For example, intrinsic investors reject the premise that companies need to do whatever it takes to meet the consensus numbers. Only 3 of 24 investors in our survey thought it was important for companies to consistently meet or beat consensus estimates for revenue or earnings. They realize there are too many factors outside management’s control to consistently meet the consensus. Most of them say they are satisfied with a company sometimes beating estimates and sometimes missing, as long as the company is making progress toward its long-term goals. That’s consistent with previous McKinsey findings that more than 40 percent of the companies that miss their consensus earnings estimates actually see their share prices rise, despite the conventional wisdom that missing analysts’ estimates invariably leads to major stock-price declines. And when stock prices do fall precipitously, it’s almost always because of other bad news that was conveyed at the same time as the earnings release.

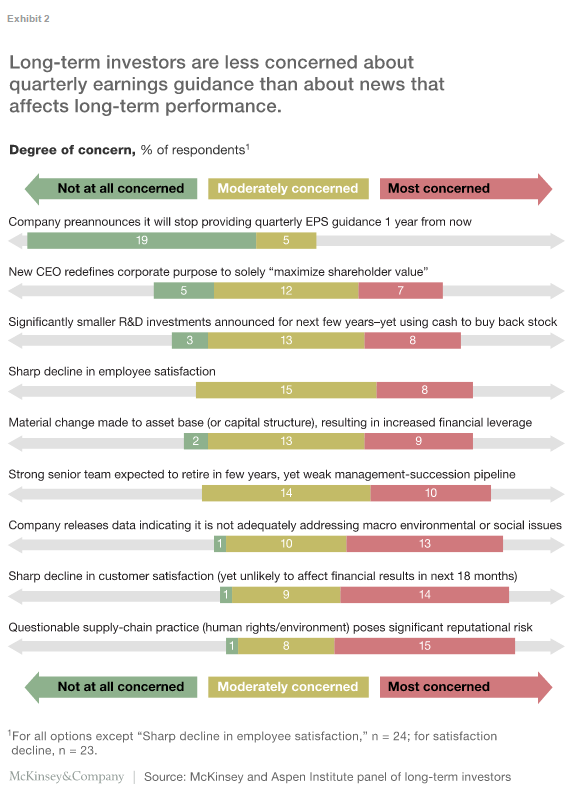

Intrinsic investors also generally oppose earnings guidance, especially quarterly guidance. Among various indicators that investors might watch, only 5 of our 24 participants said they would see a company’s announced intention to discontinue earnings guidance one year from now as a “yellow flag” or reason to keep watch (Exhibit 2). The rest said they would do nothing about their current investment in a company that decided to discontinue guidance in a year’s time.

Rethink quarterly calls

One common practice that contributes to the perceived importance of quarterly earnings is the quarterly earnings call itself. Most intrinsic investors don’t like quarterly calls and find them a waste of time. For example, when asked about how a CFO should allocate her or his time engaging with investors, only 4 of 22 long-term investors thought quarterly calls were the most important. In contrast, 19 of 24 investors preferred one-on-one meetings and less frequent but more long-term-focused investor days or strategy conferences.

From our discussions we concluded that it’s not the idea of the quarterly call itself that intrinsic investors object to. Rather, it’s the quality of the quarterly calls as practiced today. Several intrinsic investors objected that “half our time is wasted listening to a scripted speech we could easily read before the call.” Moreover, during the Q&A period, virtually all the questions are from sell-side analysts trying to enhance their quarterly earnings models rather than trying to understand how what happened in the quarter affects the long-term value of the company. The leader of a large investment company participating in our discussions decided to listen in on some earnings calls and was appalled by the poor quality of questions, including some by analysts from his own firm.

To improve the quality of earnings calls, we suggest a few experiments. One investor’s recipe for a good conference call had three parts: “Give detailed information in advance, spend as little time as possible regurgitating results already included in the press release, and focus on the Q&A. But police it more aggressively to eliminate repetitive questions, minimize short-term-oriented questions, and reduce sell-side modeling questions, such as ‘what is next quarter’s tax rate.’” Other investors described companies with helpful quarterly calls as those that remind investors of the company’s long-term strategy and goals before diving into the short-term results—and those that connect the short term to the long term during the Q&A session.

A majority of intrinsic investors surveyed favor eliminating the reading of scripted comments and giving more time to Q&A. Taking that even further, 15 out of 25 long-term investors favored asking investors or analysts to submit questions in advance—and only 3 objected. That helps companies give prominence to the questions asked most frequently and prioritize those that are most relevant to interpreting the quarterly results as indicators of long-term performance. To prevent management from avoiding important questions, a portion of the call could be devoted to questions asked “live.”

In order to have questions submitted in advance, there must be some time between the earnings announcement and the quarterly call. Investors had mixed views about the length of time between announcements and calls. Ten out of 25 respondents were comfortable with at least a 24-hour gap. In discussion, others said they preferred something shorter. For example, earnings could be released after the market closes and the call could occur the next morning. This practice is already used by some companies.

It’s time for executives to take a harder look at themselves in light of their complaints about short-term pressure. There are enough long-term investors who see themselves, as one investor put it, “on a journey with management.” By finding, working with, and making decisions with those investors in mind, managers will find their task of focusing on the creation of long-term value easier.

About the authors

Rebecca Darr was a senior fellow with the Business and Society Program at the Aspen Institute from 2007-2017 and Tim Koller is a partner in McKinsey’s New York office.

1The Aspen Institute Business and Society Program, founded in 1998, is a policy program of the Aspen Institute, a nonpartisan forum for values-based leadership and the exchange of ideas. The program works with business executives and scholars to align business decisions and investments with the long-term health of society and the planet.

2The group overall consisted of investors from 25 organizations. The sample varies because not every investor responded to every question.

3John R. Graham, Campbell A. Harvey, and Shiva Rajgopal, “The economic implications of corporate finance reporting,” Journal of Accounting and Economics, Volume 40, pp.3-73, 2005.