What would it take to provide every child in America with a $1,000 investment account? To help answer this question, Aspen FSP hosted Invest America for a dialogue featuring bipartisan policymakers and private sector leaders, supported by The BlackRock Foundation.

The event started with a panel featuring new bipartisan research from leading economists on the potential of early wealth building accounts to build wealth and bolster the economy. That panel was followed by a discussion with experts who have developed and implemented programs in Oklahoma and Maine, and the event concluded with a four-person, bipartisan panel on legislative feasibility and potential for bipartisan collaboration. Taken together, these discussions demonstrated that universal early wealth building accounts are not just a pipe dream but a powerful and achievable national policy solution that can ensure every American has a meaningful ownership stake in the economy.

Robert Shapiro (right) and Kevin Hassett (center) share their forthcoming research about the longterm impacts of early wealth building accounts in a panel moderated by Ray Boshara (left).

What the latest bipartisan research findings tell us about wealth building

Hosted in Washington, D.C., on October 21, A Public Dialogue on Early Wealth Building Accounts featured research on proposed national early wealth building programs and two established state-level programs. Presenting data from a forthcoming paper, renowned economists Kevin Hassett and Robert Shapiro made the case for a national early wealth building program that would invest $1,000 in a managed capital market account for every newborn in the U.S.

The presentation was moderated by Aspen FSP Senior Policy Fellow Ray Boshara, a national expert on wealth inequality and household financial security, who also serves as a Senior Policy Advisor at the Center for Social Development (CSD). Formerly the Managing Director of the Milken Institute, Hassett was recently appointed Director of the National Economic Council, and Shapiro is an economist and the Chairman of Sonecon, LLC, a private firm that advises U.S. and foreign businesses, governments, and nonprofit organizations.

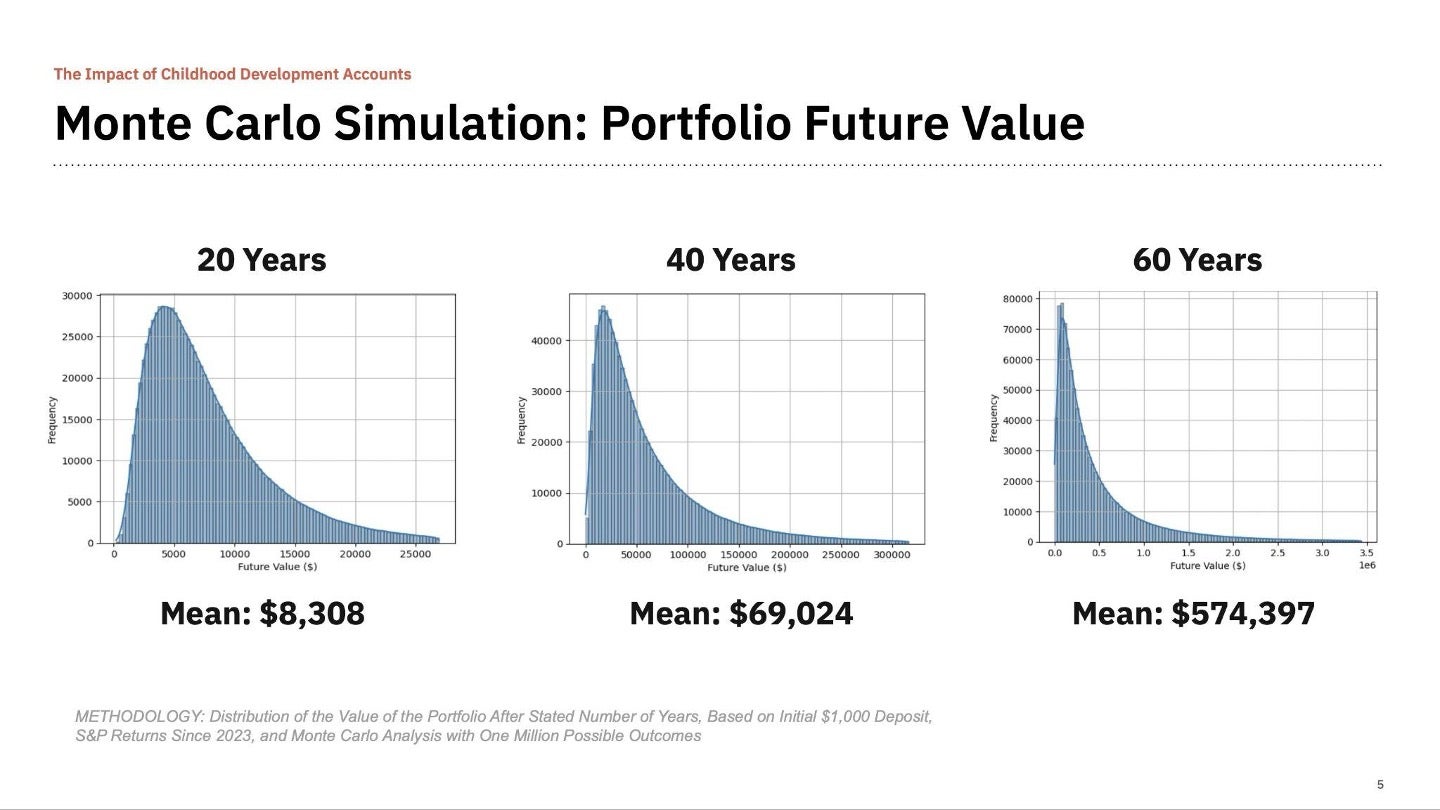

Their analysis projects that without further contribution a seed fund account could yield an average balance of $8,308 in 20 years—when many young people are considering college or workforce training. With 60 years of accrual, when people are considering and approaching retirement, that account could yield an average balance of $574,397. Hassett and Shapiro’s policy outline, and most that exist in states and in federal proposals, restrict uses of funds to wealth-building activities—usually education, homeownership, small business ownership, and retirement. These findings parallel Aspen FSP’s 2023 report, The Case for Early Wealth Building Accounts.

Hassett and Shapiro’s research includes a Monte Carlo Simulation projecting the potential mean values of early wealth building accounts after 60 years (Courtesy of Kevin Hassett and Robert Shapiro).

To explore current implementation models, leading experts Michael Sherraden of Washington University in St. Louis and Colleen Quint from the Alfond Scholarship Foundation shared insights from at-birth investment programs in Oklahoma and Maine. The longevity and impact from both are impressive. For example, over the last 10 years, Maine has provided over 145,000 children with $500-seeded accounts, and as of 2023, their combined market value totals $384 million. Importantly, both programs are invested in capital markets and show the potential of investing at birth to provide meaningful sums by the time people reach adulthood.

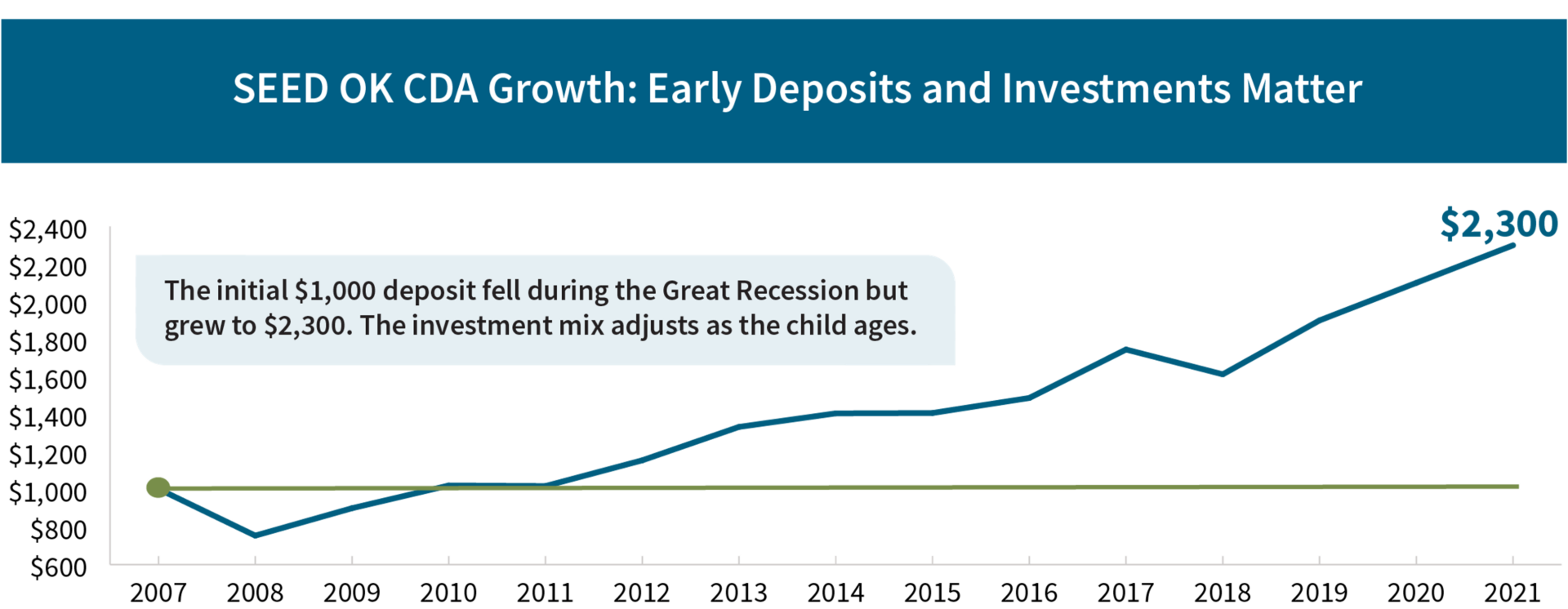

This graph shows how Oklahoma’s $1000 childhood development accounts accumulated wealth over 14 years (Courtesy of the Center for Social Development at Washington University).

In addition to the financial benefits, research found that families participating in Oklahoma’s SEED OK experimental research project between 2008 and 2020 scored better on a variety of psychosocial measures, including higher educational expectations and lower rates of depression.

Opportunities for national bipartisan policymaking

With this potential to transform household wealth, early wealth building accounts present a practical, cross-sector policy solution, and our last panel showed there is a growing and bipartisan coalition of policymakers who are working to make this idea a reality.

Sherraden and Quint’s presentations were followed by an off-the-record dialogue with Republican and Democrat Senate staffers, who offered possible policy designs and mechanisms to achieve a national early investment account policy. Building on a July 2023 Aspen FSP dialogue event, the conversation evaluated current legislation, key questions, and potential sticking points for any legislation. Staffers representing both sides of the aisle expressed their commitment to making universal early wealth building accounts a bipartisan priority.

A 2024 BlackRock survey demonstrates widespread support for early wealth building programs (Courtesy of BlackRock).

These proposals also have strong support among the electorate. Claire Chamberlain, President of The BlackRock Foundation, shared findings from a September 2024 survey by BlackRock that found that of 1,000 Republican and Democratic voters, 68 percent supported at-birth savings accounts, including a majority from both parties.

Immediate takeaways

October’s dialogue was well-timed. With a new administration and Congress in 2025, tax policy negotiations are set to take center stage, and approaching early investment with a bipartisan, cross-sector lens presents a unique opportunity for nation-wide impact.

“We are entering a critical window of opportunity to make these ideas real,” said Karen Biddle Andres, Aspen FSP’s Director of Inclusive Savings and Investing. “It’s up to us to make sure the tent is big enough and durable enough to hold all of these leaders, support and sustain their energy, and help focus their efforts on the most important design principles and choices that can help deliver real financial security to America’s next generation.”

Chamberlain added, “These proposals represent tremendous potential to harness the power of the capital markets for future generations, to begin building lifetime wealth and increasing economic mobility. The BlackRock Foundation is proud to help drive dialogue around these ideas and support InvestAmerica24 and The Aspen Institute in line with our mission to help people earn, save and invest—earlier, more often, and for their futures.”

While much work remains, several immediate takeaways are clear:

- Universal early wealth building accounts have widespread, bipartisan appeal because of their demonstrated financial impact, including on financial education, and their positive effect on family well-being.

- Investing funds in capital markets is a compelling approach to both national and state programs and policies.

- There is strong momentum to build on in 2025 as policymakers and other key stakeholders engage in discussion on early wealth building proposals.