Disclaimer: Names and identifying details have been changed to protect the privacy of individuals.

The numbers across the United States are alarming: 50 million unemployment filings, 40 million at risk of eviction, and 6 million missed housing payments in September 2020, alone. Each day brings new estimates that reveal what economists have been warning—the foundation of household financial security is cracked.

The COVID-19 pandemic has unraveled the financial lives of many individuals. But even before this—during the longest period of sustained economic growth in modern US history—millions were struggling to find stability. Now, amid inadequate government responses to health crises, school closures, and job layoffs, we’re hearing more stories from households that were already teetering on the edge of precarity, unable to pay rent or mortgage.

“My housing situation didn’t get any worse [during the pandemic] because it was already bottom of the barrel awful to begin with. It’s like we have to choose between housing and thriving.” – Leah, a focus group participant

The Aspen Institute Financial Security Program (Aspen FSP) regards the voices of impacted people as an invaluable addition to our financial security research. In October 2020, we partnered with SaverLife, a technology-enabled nonprofit that helps people build savings, to survey 499 SaverLife members about their experiences with housing insecurity and to conduct focus groups with a subset of respondents. SaverLife members are a community of economically, geographically, and racially diverse individuals dedicated to improving their financial lives. Our work with SaverLife has allowed us to investigate the deep connections between housing and financial security and to better understand the lives of impacted individuals.

Here are three stories that elevate people’s real housing experiences and expose why housing policy is critical now and for the future.

Morgan received an eviction notice at the height of the pandemic

“I live in California. I work in retail. And right now, I’m homeless,” says Morgan, a single mother of two. “My family was given a seven-day notice to vacate the premises.” This story isn’t uncommon. Many renters entered the pandemic already facing housing instability and vulnerable to eviction. The Eviction Lab at Princeton University estimates that between 2000 and 2016, 61 million eviction cases were filed in the US, an average of 3.6 million evictions annually. Eviction moratoriums are an important policy tool implemented earlier this year to stop landlords from evicting tenants who can’t pay rent, but not all households have been protected.

In Morgan’s hometown, the eviction moratorium expired in late August, giving landlords a window to serve eviction notices. “We tried to talk to the judge,” she explains, “to see if we could get a little longer. The judge didn’t want to hear our story, didn’t want to hear nothing.” State and local rental assistance programs have provided some relief, but funds fall short of what is needed. For individuals like Morgan who work a minimum wage job, there are many barriers to accessing affordable rental housing. “I’m trying to find a place but it’s really crazy. Everything is waitlisted. And they’re not only asking for first month’s rent and a security deposit, but they’re asking for you to make three times the amount of rent. Right now, it’s impossible, especially working in retail,” says Morgan. “My biggest struggle has been worrying. I’ve lost weight. I’ve lost hair.”

Annie’s American dream is threatened by job instability and pre-foreclosure

“I live in Massachusetts. We have five people living in a two-bedroom home,” reveals Annie, who has lived in her home for 15 years with her husband, her children, her dad, a dog, a cat, and a parakeet. A couple of years ago, Annie tried to buy a larger house. “I was only preapproved for $175,000,” she laments. “Where I live, you can’t buy anything for that money.” Homeownership is a staple in the American Dream, but one that is not accessible to all, especially people of color. Mortgage financing, down payments, and closing costs are common barriers for potential homebuyers. Although government and nonprofit programs offer assistance to homebuyers, high demand, long waits, and strict requirements can prevent people from accessing them.

Even before the COVID-19 pandemic, families were struggling to afford their housing costs. More than 18 million—or 1 in 6—were paying over half of their income on housing. For Annie and her husband, high housing costs resulted in them defaulting on their mortgage loan. They’ve been in and out of pre-foreclosure since. “Everything is so expensive,” she laments. “It’s not only the mortgage, it’s the upkeep of the property. This is an old house. There’s always something to do.” Unfortunately, Annie’s job was impacted by the pandemic, forcing her family to give up on plans of buying a new home that fits their needs. “When COVID-19 hit, I had to leave my job. My husband owns a construction company, but not a lot of people are building right now,” she says. The pandemic has impacted dozens of major sectors in the US economy this year, deeply disrupting the financial lives of many families like Annie’s.

A recent disability contributes to Leah’s severe rent burden

“I live in Upstate New York. I ended up becoming disabled and can no longer work,” began Leah, a thirty-something who lives alone. Leah receives disability and food assistance each month to help manage living costs. “Fortunately, where I’m living is pretty cheap, but 57% of my income goes towards rent every month. My life fell apart when I got disabled.” The US Department of Housing and Urban Development (HUD) defines severe housing cost burden as those paying more than 50% of their income on housing. Any housing cost burden above 30% has strong associations with difficulty affording necessities like food, clothing, transportation, and medical care.

“I tried to find a way to make my housing more affordable. We have lots of luxury housing here but very little affordable housing,” says Leah. Many low-income individuals cannot afford the housing available to them, and there often is not enough affordable supply to meet growing demand. A year ago, Leah applied for the Section 8 Housing Choice Voucher Program, which opens once every five to seven years where she lives. “They did lottery drawings from the waitlist. I’ve never managed to get on.” This is no surprise. While federal rental assistance is very effective, 3 in 4 eligible low-income renter households do not receive it due to funding limitations.

For Leah, housing stability is just as necessary as affordability. “I moved here in a hurry. My last landlord was doing a lot of shady things, threatening me to move,” explains Leah. She chose to leave her prior housing situation before things escalated. “I ended up having to leave my security deposit behind. It was pretty awful. And there was nothing I could do about it.” This type of harassment is a tactic used by some landlords to informally evict tenants from their properties. Other documented ways that landlords have informally evicted tenants include shutting off the power or throwing out belongings. “I’m on a month-to-month lease, now. If my new landlord wants me to leave, I have nowhere to go. I have no family. I have nothing to hold on to.”

Survey results confirm housing is central to financial security

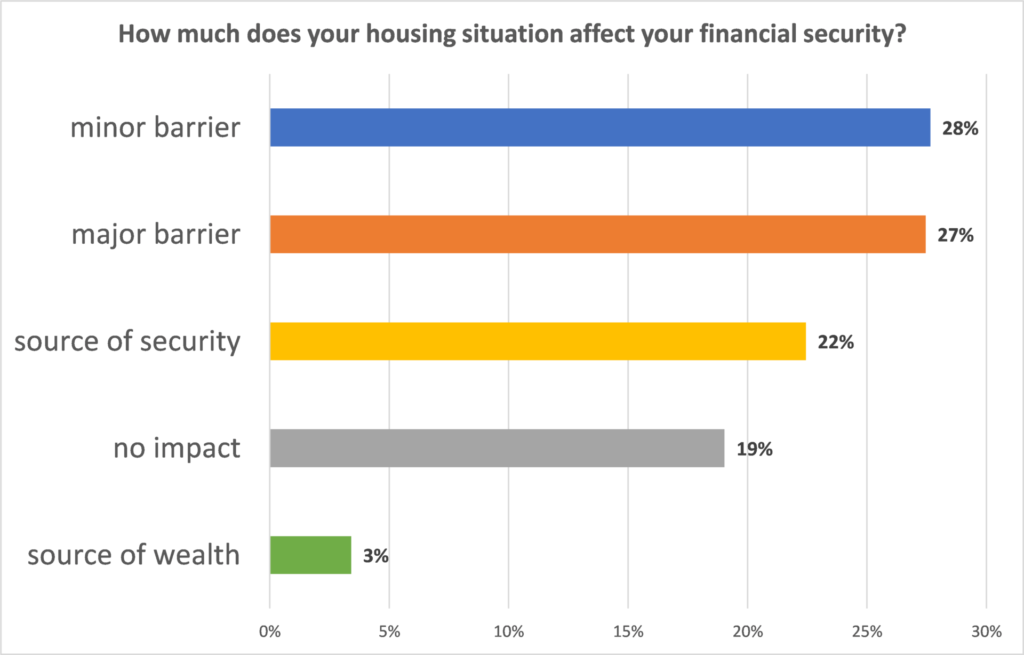

The survey conducted with SaverLife received 499 responses from a diverse set of SaverLife members. The results reinforce what our broader research finds: affordable and stable housing is deeply connected to financial security in many ways. Over half of survey respondents believe that their housing situation is a barrier to their financial security (Figure 1). These respondents were also more likely to have a high or severe cost burden. Renter respondents were 2 times more likely than homeowners to report a housing challenge, such as high housing costs, late rent or mortgage payments, or limited job options due to housing location.

Even though they experience higher cost burdens, renters that we surveyed report facing many barriers to accessing federal rental assistance. This leaves renter households with greater financial precarity and more at risk of eviction and homelessness. Despite this, 48% of renters were optimistic about buying a home one day. Respondents who successfully bought homes say many unexpectedly high costs have threatened their stability, including home maintenance, as Annie described, and property taxes.

We asked respondents to describe, in their own words, “How would your life be different if your housing security problems were solved?” The most profound impact that people say they will experience is less mental and physical stress, especially in the wake of the COVID-19 pandemic. Households say they’d be able to pay for other basic needs, pay down debts, save for emergencies, and use more disposable income to buy better housing, make home repairs, vacation, and invest in retirement and education.

A new report illuminates the path forward

The historic election of the Biden-Harris administration could be the catalyst needed to rebuild a nation that prioritizes housing security for all. To set our country on an inclusive path to growth, resilience, and well-being, housing security must be at the core of economic and pandemic recovery efforts. Although a patchwork of policy responses implemented nationwide, statewide, and locally have been somewhat effective, they have not provided comprehensive protections nor been funded at a level commensurate with the scale of the problem.

This month, Aspen FSP released a new report—a solutions framework—that points the way out of our current housing crisis to a more stable and prosperous future for America. Our earlier research primer identified four root causes of our current situation: 1) there is not enough housing to meet growing demand; 2) many families cannot afford the housing available to them; 3) discrimination continues to harm people of color; and 4) current policy disadvantages renters. This new report will provide housing stakeholders working across sectors, in communities, in businesses, and all levels of government, with a toolkit of strategies they can use to provide America with a strong foundation of housing – and financial security.

To learn more, watch the discussion from our event Building Housing Security During COVID-19 and Beyond and read our report, “Strong Foundations: Housing Security Solutions Framework.”

This work was done in partnership with SaverLife.