Since 2008, creative and dedicated WealthWorks practitioners have been finding answers to the question of how to advance equitable regional prosperity by working with the unique assets of rural regions – the WealthWorks approach. WealthWorks orients community development efforts to an analysis of the full range of community assets with market demand in ways that build livelihoods that last. This 21st-century approach to local and regional economic development that belongs in every community and economic development toolkit.

In partnership with the WealthWorks hubs and other national partners, Aspen CSG is proud to showcase the redesigned and updated WealthWorks website. Use the links below to explore how WealthWorks was developed and how it may fit into your community and economic development plans – and we invite you to immerse yourself in WealthWorks by diving deeply into the website.

WealthWorks and Thrive Rural

WealthWorks is an approach to doing economic development differently that inspired and continues to inform the Thrive Rural Framework, particularly the Local Theory of Change and is a recommended starting point of engagement for communities utilizing the Thrive Rural Framework. While they can work hand-in-hand, there are a few crucial differences between these two asset-based frameworks:

— WealthWorks is primarily an economic development framework that works at the local and regional level to build economic opportunities and assets for those on the economic margins.

— The Thrive Rural Framework is more holistic and urges local and systems-level action to effect positive change — within and beyond economic development. Its ultimate outcome is that rural communities and Native nations are healthy places where each and every person belongs, lives with dignity, and thrives.

Aspen CSG sees the WealthWorks approach as critical to the development of theThrive Rural Framework. For each of the core WealthWorks components laid out below, we highlight how WealthWorks and the Thrive Rural Framework work together for a more prosperous rural future.

History and Evolution of WealthWorks

WealthWorks is a practitioner-led approach to building a more inclusive economy where economically marginalized people and places grow wealth through market engagement. WealthWorks is not theoretical; it was co-created by a group of practitioners doing the work in their communities and regions.

Since 2008, it has been continuously tested and refined through the experiences of people and organizations putting it to use in communities and across regions. In 2011, the Ford Foundation engaged Aspen CSG as the lead coordinator and national partner for the WealthWorks approach. Since then, Aspen CSG’s primary role in this work has been to develop tools, videos, and stories that make the WealthWorks approach to building livelihoods understandable and doable by all interested and motivated people, organizations, and places doing community and economic development. Its success stories show its application in housing, energy efficiency, renewable energy, food and agriculture, fisheries, forestry and wood products, financing, tourism, health care, and transportation.

WealthWorks is an evolving community of practice continually exploring, implementing, and testing innovative regional wealth-building strategies. Today, the community is self-organizing, guided by a group of regional hubs and national partners, including Aspen CSG, the National Association of Development Organizations, and the Rural Community Assistance Partnership. We invite all those who are interested in this innovative approach to join us!

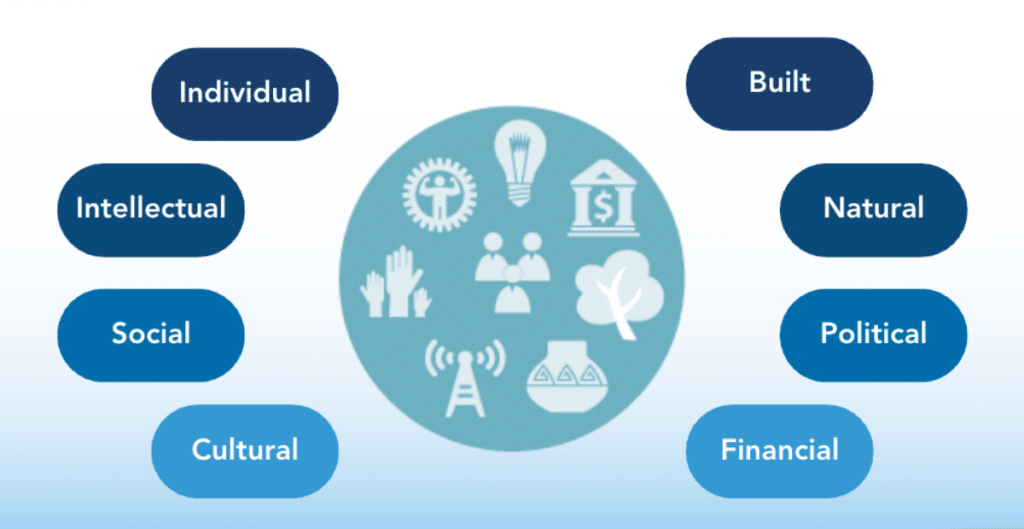

Eight Capitals for Wealth Building

WealthWorks is a community-centered, network-oriented approach to community and economic development. The WealthWorks’ wealth-building approach allows communities to focus on what they have — instead of what they lack — to generate new and sustainable economic opportunities rooted in local people, places, and businesses.

The principles of wealth creation provide a lens through which to view potential opportunities. WealthWorks’ eight capitals offer a touchstone for communities and regions to focus on what makes them special. Rather than operating from a deficit mindset, the eight capitals provide a way to focus on the strengths of these communities, including tangible and intangible assets that connect to well-being and quality of life.

WealthWorks Modules

Explore Regional Wealth Building

Community and regional assets also rest at the core of the Thrive Rural Framework, and WealthWorks’ well-established framing of how to do economic development differently influences many of the building blocks that make up the framework. For instance, by focusing on growing and harnessing local assets, WealthWork’s wealth-building approach can help a region strengthen local ownership and control of assets overall (a Thrive Rural Framework building block). WealthWorks and the Thrive Rural Framework both envision a future where businesses, institutions, organizations, and resources critical to the community and its future are owned locally and/or directed and advised by the full range of community members with a stake in their durability and success.

Both WealthWorks and Thrive Rural also focus on wealth building to support those living and working on the economic margins and those who have been discriminated against based on their economic class, their racial, immigrant, or cultural identity, or the place where they choose to live. The Foundational Element of the Thrive Rural Framework requires identifying and dismantling historical and ongoing discriminatory practices that disadvantage rural people and places.

Identify a Market Opportunity

A core component of WealthWorks involves building value chains in specific sectors. A WealthWorks value chain is a network of people, businesses, organizations, and agencies addressing a market opportunity to meet demand for particular products or services – advancing self-interest while building rooted local and regional wealth.

However, a sector is too broad for value chain development. It’s essential to drill down to a specific market opportunity within a sector that has the potential to generate multiple forms of wealth in a region. As wealth building is a demand-driven approach, it’s critical to understand the demand for a particular market opportunity and match that demand to the assets and strengths of the region.

The Thrive Rural Framework articulates setting market opportunity goals in a compatible but slightly different way by urging users to balance development goals as market opportunities are developed. As a result, local actions must concurrently strengthen a community’s infrastructure, economy, and natural environment to advance the sustainability and durability of all three to foster prosperity.

Construct a Value Chain

As a demand-driven approach, a WealthWorks value chain starts with demand, considering the final consumers/end markets (buyers), mapping out the functions that need to happen to move from supply to demand, and identifying key partners that play a direct or indirect role in moving the product/service along the chain.

One key to the success of a value chain is a coordinator. The coordinator serves as the backbone of a WealthWorks value chain, weaving together the efforts of everyone involved by:

- Holding and stewarding the vision of the value chain.

- Building relationships among and between partners in the value chain.

- Guiding activities and partnerships to build multiple forms of wealth.

- Ensuring people, firms, and places on the economic and social margins participate and benefit.

- Helping create and deploy structures to manage risk.

- Maintaining flows of information to keep mutual benefit going.

Coordination is key to building wealth that sticks in rural communities and Native nations. The Thrive Rural Framework building blocks linked in the following sentences help to articulate how this coordination needs to be regional to succeed. Acting as a region means that communities persistently analyze, develop strategies, and act together within and across sensible and workable regions to address shared issues, challenges, and opportunities and achieve outcomes at a productive scale. In turn, regional analysis and action help to develop systems of public and private policy, investment, and incentives that encourage and stimulate collaborative regional action and the capacity of regional efforts to address shared cross-community economic, social, and health challenges and opportunities.

Gauge Wealth Building Impact

A critical component of any community and economic development initiative is gauging impact to attract new investors and justify community effort. WealthWorks’ evaluation framework suggests that a community or regional effort can measure the positive change they have made by comparing the relative change in the eight forms of capital.

This evaluation framework is one of the many rural-specific evaluation tools gathered in Aspen CSG’s annotated list of measurement tools produced for Measure Up: A Call to Action. This report highlights six principles for measuring rural development progress to open and deepen conversations about better ways for funders and investors to design programs that consider lower-capacity communities’ realities, needs, and goals. NADO’s Measuring Rural Wealth Creation is another valuable resource that can help communities and value chain coordinators understand their impact.

We’re so pleased to share the refreshed WealthWorks website with you and hope it continues to aid your efforts to build economic opportunities and assets for those on the economic margins.

As the scope of your work expands, the Thrive Rural Framework can help any development effort set goals and track progress over time. You can use the information you gather at each step to repeat the action cycle (Take Stock, Target Action, Gauge Progress) as you make progress on your goals.

Please reach out if you have any questions on either of these frameworks. Together, we can create stronger, healthier rural and Indigenous communities where each and every person belongs, lives with dignity, and thrives.

This blog was written in collaboration with Melissa Levy of Community Roots (one of the six WealthWorks regional hubs) and NADO, and Bonita Robertson-Hardy and Devin Deaton of Aspen CSG, one of WealthWorks’ three national partners.