The financial challenges faced by financially vulnerable Americans continue to change as the economic, political, and social landscapes evolve at an increasingly rapid pace. We gather new key insights every time we talk with financially vulnerable people directly – experts on their own lives. They have insights to share about both the challenges and the ingenious solutions they have engineered to meet them.

We worked with the New York City Department of Youth and Community Development to learn how summer youth workers think about their financial habits, goals, and action taking. Our new infographic highlights findings specific to urban youth of color, including why those who saved felt able to do so, and what stopped those who didn’t save.

We talked with minimum wage workers in California in collaboration with their employers. Rise with the Raise: California details some of these findings, including that workers want immediate access to saved money, but appreciate restrictions that reduce the temptation to make withdrawals. As one worker said, “I keep my saved money with my boss, who lives 4 hours away. I know I can access my money if I ever needed it, but the distance keeps me from the temptation to spend it.”

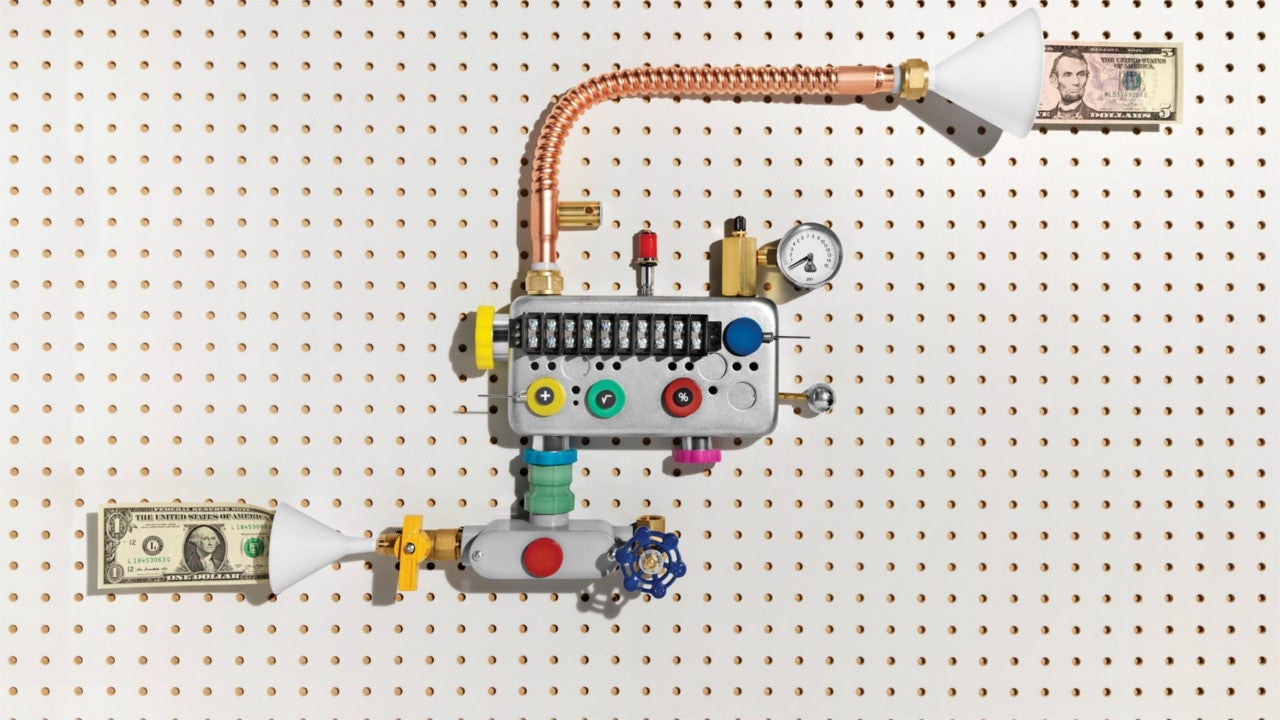

We’ve been talking with Boston families about their experiences saving for their children’s education through Boston Saves, a Children’s Savings Account program sponsored by the City of Boston. Findings show that parents are interested in products that allow them to save for the long-term, but have “emergency valves” for access in case of financial emergency. We’ve also found that recent immigrants spread their savings between institutions to ward against bank failures that they fear based on experiences in their home countries. Watch for a full report on these findings in the coming months.

On July 1, we launched a new national project to learn directly from independent workers about the unique financial challenges they face and the ingenious solutions they have engineered. There has been much talk in the press about the growth of the “gig” economy but little insight into the experiences of these workers. Collecting these missing insights is crucial to developing successful products and policies that will work for independent workers.

We are committed to bringing the voices of experts, including the financially vulnerable, into every discussion to create better and more effective solutions to financial challenges.

This piece originally appeared on buildcommonwealth.org.