Our Person-Centered Approach

To understand the current challenges facing U.S. households, Aspen FSP works with the people who have experienced them firsthand. Their insights form the foundation of Aspen FSP’s strategy and research.

Centering Communities

We know that for systems to reflect the needs of the people affected by them, people need power and influence over how these systems are designed and operated.

That’s why our person-centered approach prioritizes the wisdom and leadership of people who have experienced financial insecurity. Their insights inform Aspen FSP’s research and dialogues, uncovering the barriers that prevent U.S. families from building wealth and well-being.

Then, together with community and organizational leaders on the frontlines of these issues, we co-create and support the policy and market solutions that can address these barriers.

Our Community Advisory Group

Our Community Advisory Group (CAG) helps shape and direct Aspen FSP’s strategic priorities. Composed of six leaders with direct experience of financial insecurity, the group provides deep, ongoing feedback into our work.

We established the CAG in December 2021 to learn from on-the-ground leaders who are working to advance financial security in their communities through organizing, advocacy, and direct service. Since then, the CAG has worked with internal and external partners, developing effective, responsive solutions across our portfolios.

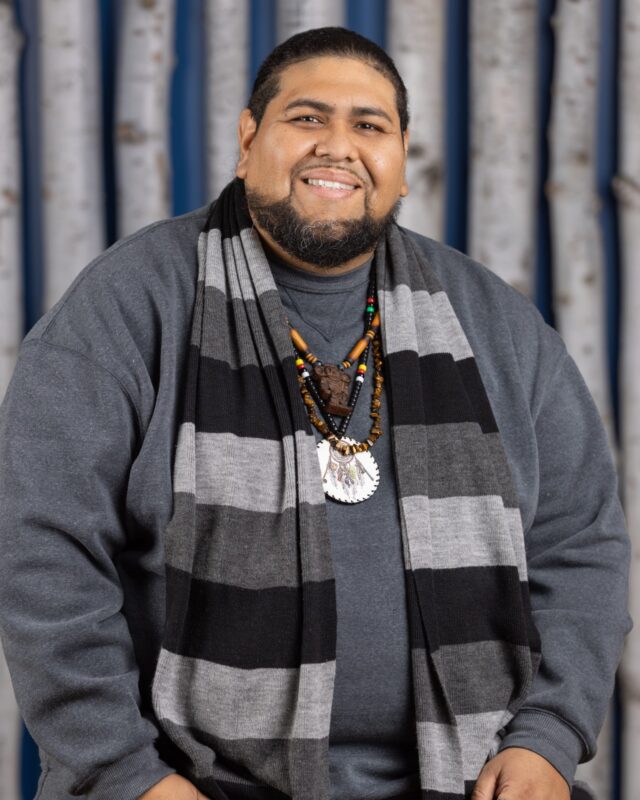

Community Advisory Group Members

“I often say, ‘If you’re not at the table, you’re on the menu.’ With Aspen FSP, they invited us to the table, gave us the menu, and said, ‘What’s the order for today?’

That’s the person-centered approach.”

Callie Greer, Community Advisory Group Member

Stay Connected

Join our work to build financial security for all.

Learn more about how you can support the Aspen Institute Financial Security Program through a philanthropic grant, tax-deductible gift, or event sponsorship.

Stay up to date with our latest news and events.