Nonprofit Data Project Updates

June 16, 2016

We are thrilled to share this historic news about open, nonprofit data.

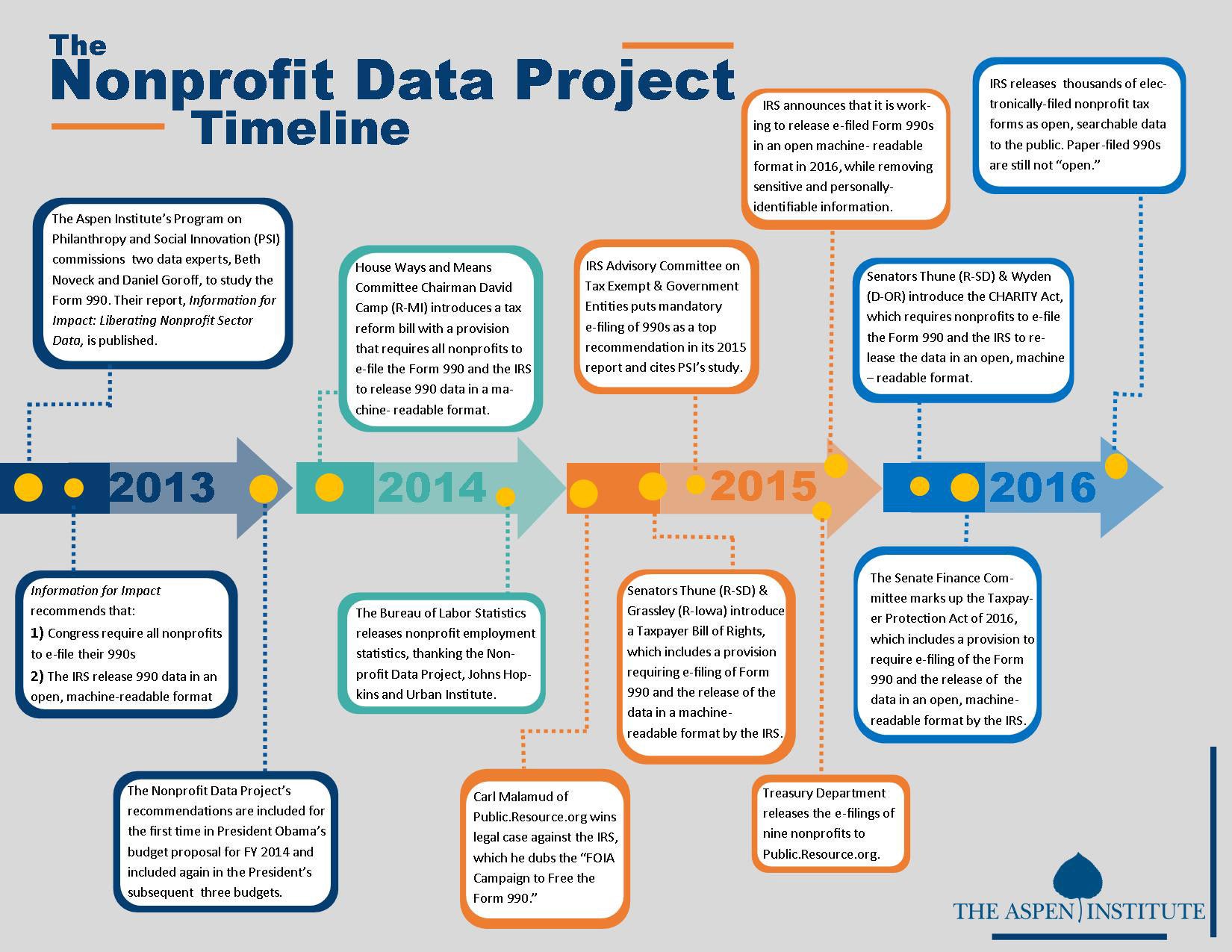

Just three years after the Aspen Institute’s Program on Philanthropy and Social Innovation (PSI) published its groundbreaking report, Information for Impact: Liberating Nonprofit Sector Data, the IRS has released electronically-filed nonprofit tax forms in bulk, as open, machine-readable data to the public.

These electronically-filed tax forms comprise approximately 60% of Form 990s and are available through the public data sets on Amazon Web Services. Data for each Form 990 filing is provided in an XML file, which can be used by coders to gather and aggregate information on the nonprofit sector.

Form 990s are full of valuable information on nonprofit mission, governance and finances for a sector that comprises over 10% of private sector employment and over 5% of GDP.

But until now, even electronically-filed 990s were only available and sold by the IRS as non-searchable images. A year’s worth of 990s, both e-filed and paper-filed, cost $2,850 for a set of DVDs. Once purchased, the 990s had to be re-typed to render them searchable and more useful.

The potential of open data is great. Form 990 information, when searchable and available in bulk download, allows for analyses and visualizations that transform data into knowledge and useful applications for our society. Open Form 990 data increases transparency, reduces fraud, improves efficiency and accuracy, and provides more opportunities for innovation.

Now, after several years of pressing from PSI’s Nonprofit Data Project and many of you in the nonprofit, public and private sectors, 990 data are moving into the 21st Century. We are grateful for the work of Carl Malamud and his 2015 federal court victory, Public.Resource.org v. IRS, which was a major factor in today’s news.

Many thanks to PSI’s Nonprofit Data Project partners: GuideStar, Urban Institute, Foundation Center, Indiana University and Johns Hopkins University, as well as our funders, the Charles Stewart Mott Foundation and the Bill & Melinda Gates Foundation and the authors of our Form 990 report, Beth Noveck and Daniel Goroff. They, and many other partners in this effort, have helped to lay the groundwork and lead the way.

Our work is not over, however. Paper-filed 990s, about 40% of the forms, are still unavailable as open data. Fortunately, this new development joins a growing chorus favoring open 990 data. For example, federal lawmakers have put forth provisions in bi-partisan legislation – such as the Charities Helping Americans Regularly Throughout the Year (CHARITY) Act, and the Taxpayer Protection Act of 2016 (recently approved by the Senate Finance Committee) – which would require all nonprofits to file their tax forms electronically and the IRS to release the data in an open, machine-readable format.

As always, we will keep you informed of breaking developments on nonprofit data. Please contact me atcschuman@aspeninstitute.org with any questions.

October 27, 2015

The White House released its third Open Government National Action Plan, which included 40 new or expanded initiatives to advance the Presidents open government commitment.

We are delighted with the recommendation to Proactively Release Nonprofit Tax Filings. As PSIs Nonprofit Data Project has urged, the plan commits the IRS to release electronically-filed Form 990s as machine-readable, analyzable data, allowing the public to review the finances and other information of more than 340,000 American nonprofit and charitable organizations. In 2014, about half of nonprofit tax returns (not including the Form 990-N) were electronically filed.

Mary Beth Goodman and Megan Smith wrote the White House blog post, Advancing Open and Citizen-Centered Government, to share the news of the reports release, and they highlighted the 990 commitment as one of five examples. The release of the report coincides with the Open Government Partnership Summit in Mexico City, which occurred later that week. The White House promises more meetings, including an Open Data Impact Summit, in the future.

July 9, 2015

A bi-partisan working group of the Senate Finance Committee has released a report that includes a proposal to require electronic filing of the Form 990 by all nonprofits that file, coupled with the release of machine-readable 990 data by the Internal Revenue Service (IRS).

The Senate proposal would enable the public to easily search and analyze all nonprofit tax forms for useful information on nonprofit activities. The bi-partisan group, chaired by Senators Cardin and Thune, has been working for several months to develop shared principles for tax reform.

The Senate proposal is not yet law, but its inclusion in the bi-partisan working group report is a critical and promising development. Should it become law, the proposal would include transition relief for certain small organizations, or other organizations for which the application of the e-filing requirement would constitute an undue hardship in the absence of additional transition time.

June 30, 2015

The IRS announced that it is actively working towards releasing electronically-filed Forms 990 to the public in a machine-readable format in early 2016. This would enable the public to easily search and analyze the tax forms for helpful information on nonprofit activities.

According to the statement released on June 30, the IRS will actively consider how to use new technology that will allow it to release electronically-filed Forms 990 in a machine-readable format, while removing sensitive or personally identifiable information from public distribution.

This major shift in IRS policy comes weeks after the IRS provided machine-readable versions of nine Forms 990 to Carl Malamud ofPublic.Resource.Org, who filed a successful federal lawsuit based on the Freedom of Information Act. This legal precedent led several news outlets, including The Washington Post and the Chronicle of Philanthropy, to file a series of FOIA requests for electronically-filed Form 990s last week.

IRS policy, to date, has been to release only non-searchable images of the tax forms to the public, for a fee, even if the forms were electronically-filed to begin with. In 2014, approximately 48 percent of the Form 990 series (other than Form 990-N postcard) were e-filed; this includes 60.10 percent of the Forms 990, 37.63 percent of the Forms 990-EZ, and 41.15 percent of the Forms 990-PF.[1]

[1]This information is taken from page 97 of the 2015 Report of Recommendations put forth by the Advisory Committee on Tax Exempt and Government Entities and can be accessed here.

June 17, 2015

The Advisory Committee on Tax Exempt and Government Entities made mandatory 990 e-filing its top recommendation for exempt organizations in a report released to IRS officials. The committee produced survey results finding that less than two percent of organizations that file 990s by paper view mandatory electronic filing as a burden. The report highlights Aspen Institute’s seminal research study, Information for Impact: Liberating Nonprofit Sector Data.

June 16, 2015

Senators Thune and Grassley – both influential members of the Senate Finance Committee – introduced a bill which includes a provision requiring electronic filing of the Form 990 and the release of the data by the IRS in an open, machine-readable format that will produce much more useful information about the nonprofit sector. The e-filing provision is part of a larger bill to improve customer service at the IRS; it echoes a similar provision in President Obama’s FY 2016 budget, released in February.

To receive the latest updates from the Nonprofit Data Project, please email Cinthia Schuman Ottinger at CSCHUMAN@ASPENINSTITUTE.ORG with the subject line “Nonprofit Data Project Updates.”