Consumer debt is ubiquitous. Although at any given time some Americans are debt-free, most of us carry debt some or even all of the time. We borrow for various reasons, and we are increasingly likely to incur debt also from non-loan sources (such as an out-of-pocket medical expense or being assessed a governmental fine or fee). Consumer debt is not inherently bad (taking on debt can often be a sound financial decision), but it is a concern today because it has reached record levels, and its effects reach deeply into financial security, physical and mental health, as well as the broader economy. Consumer debt is a systemic problem with significant consequences, but there are systemic solutions.

CLICK HERE TO VIEW THE FULL FRAMEWORK

CLICK HERE TO DOWNLOAD THE EXECUTIVE SUMMARY

With solutions ranging from product-level improvements to broader reforms, the Aspen Financial Security Program’s the Expanding Prosperity Impact Collaborative (EPIC) has identified options for stakeholders in every sector and for partnerships across sectors. Collectively, these solutions possess tremendous potential to address a critical dimension of household financial insecurity.

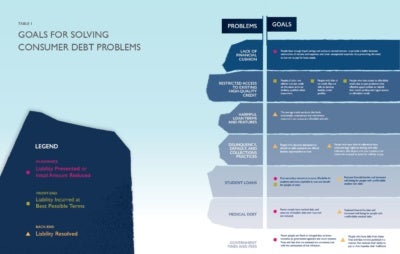

EPIC’s research has identified seven specific consumer debt problems – all amenable to solutions – that result in financial insecurity and damage well-being.![]() Four of the identified problems are general to consumer debt: households’ lack of savings or financial cushion, restricted access to existing high-quality credit for specific groups of consumers, exposure to harmful loan terms and features, and detrimental delinquency, default, and collections practices. The other three problems relate to structural features of three specific types of debt: student loans, medical debt, and government fines and fees.

Four of the identified problems are general to consumer debt: households’ lack of savings or financial cushion, restricted access to existing high-quality credit for specific groups of consumers, exposure to harmful loan terms and features, and detrimental delinquency, default, and collections practices. The other three problems relate to structural features of three specific types of debt: student loans, medical debt, and government fines and fees.

SHARE

![]() New Solutions Framework from #AspenEPIC identifies the significant consequences of consumer debt, especially for low- and moderate-income households and other financially vulnerable Americans. https://buff.ly/2Tes3wH

New Solutions Framework from #AspenEPIC identifies the significant consequences of consumer debt, especially for low- and moderate-income households and other financially vulnerable Americans. https://buff.ly/2Tes3wH